Annual Returns Comparison

|

|

||||||

| |

||||||

NASDAQ (OTC) |

|

S&P 500 (VFINX) |

||||

| |

||||||

Year |

With

|

Without |

With

|

Without |

Year |

|

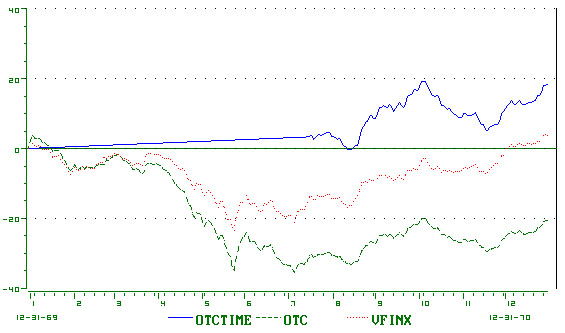

1970 1970 Return |

17.9%

|

-22.5%

|

|

24.1%

|

3.9%

|

1970

|

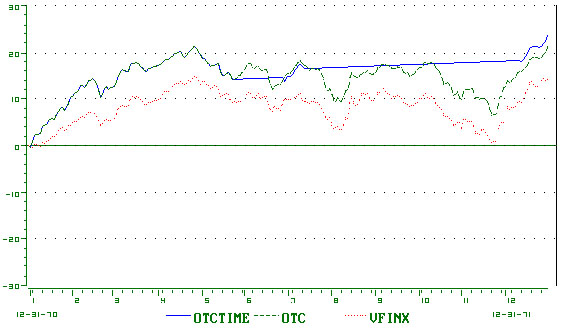

1971 1971 Return |

25.2%

|

21.2%

|

|

16.6%

|

14.2%

|

1971

|

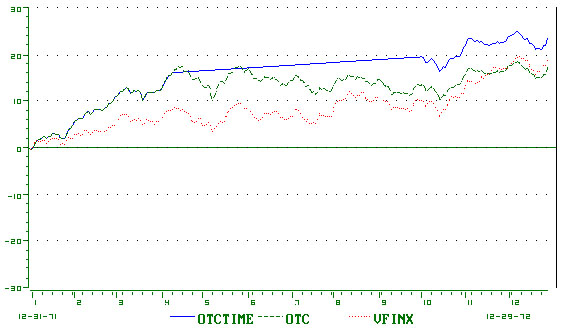

1972 1972 Return |

23.5%

|

17.2%

|

|

20.2%

|

19.0%

|

1972

|

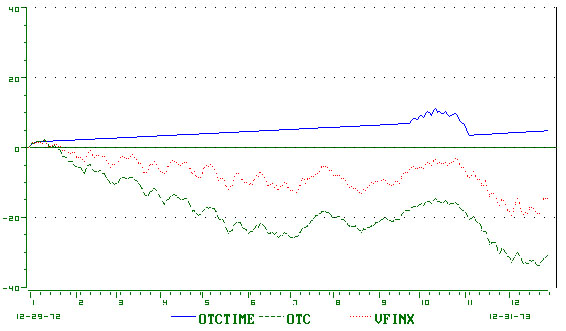

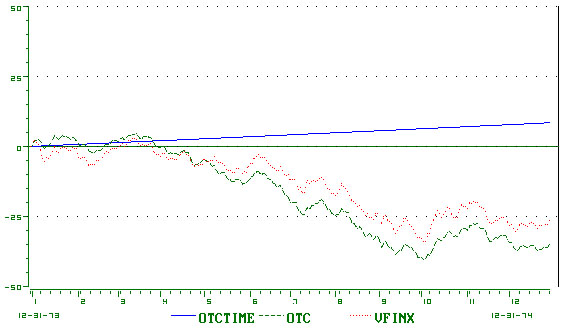

1973 1973 Return |

3.2%

|

-31.1%

|

|

6.1%

|

-16.7%

|

1973

|

1974 1974 Return |

8.0%

|

-35.1%

|

|

8.0%

|

-24.3%

|

1974

|

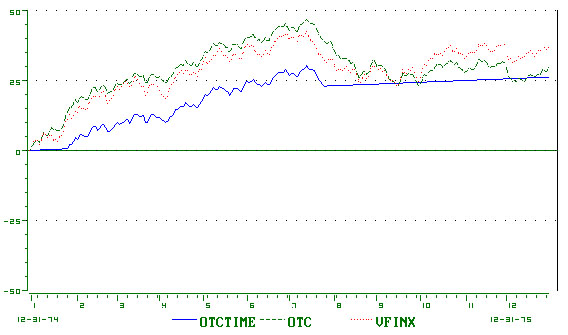

1975 1975 Return |

26.2%

|

29.8%

|

|

22.8%

|

37.1%

|

1975

|

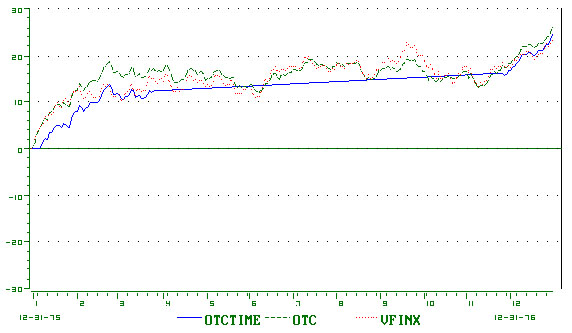

1976 1976 Return |

24.1%

|

26.1%

|

|

18.3%

|

23.8%

|

1976

|

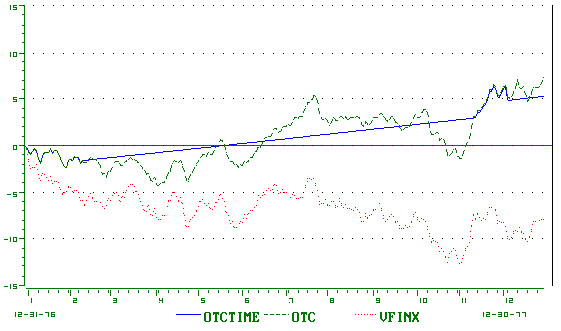

1977 1977 Return |

5.3%

|

7.3%

|

|

-4.1%

|

-7.2%

|

1977

|

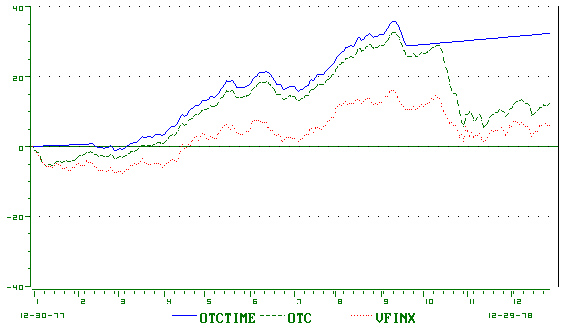

1978 1978 Return |

32.8%

|

12.3%

|

|

19.2%

|

6.5%

|

1978

|

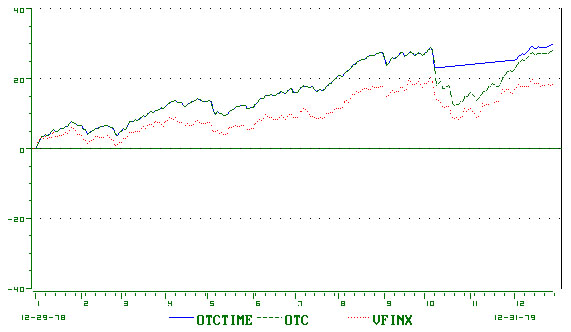

1979 1979 Return |

28.8%

|

28.1%

|

|

17.5%

|

18.5%

|

1979

|

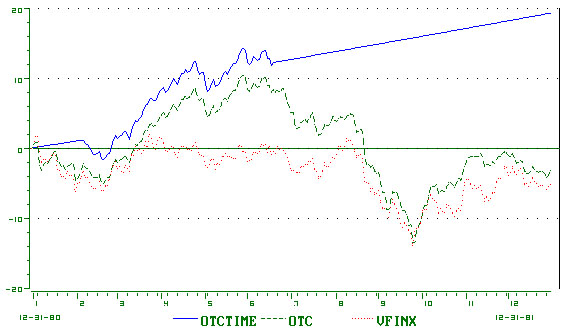

1980 1980 Return |

54.2%

|

33.9%

|

|

47.8%

|

32.4%

|

1980

|

1981 1981 Return |

19.4%

|

-3.2%

|

|

10.7%

|

-4.9%

|

1981

|

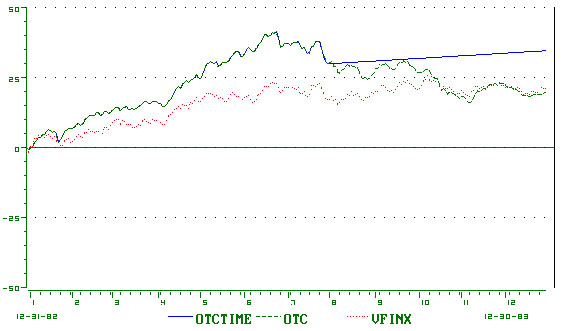

1982 1982 Return |

36.0%

|

18.7%

|

|

25.8%

|

21.5%

|

1982

|

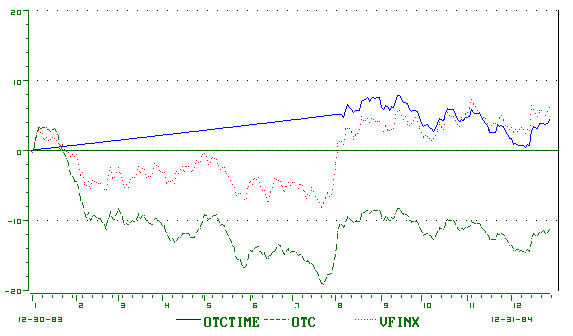

1983 1983 Return |

34.9%

|

19.9%

|

|

21.6%

|

22.5%

|

1983

|

1984 1984 Return |

4.5%

|

-11.2%

|

|

10.2%

|

6.2%

|

1984

|

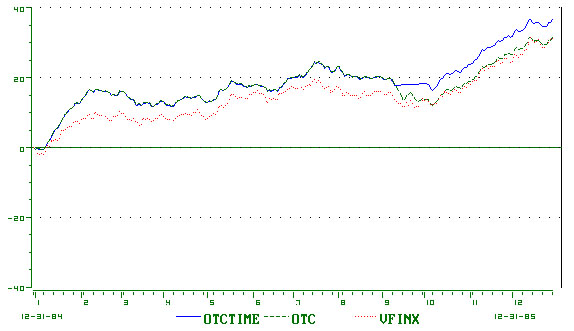

1985 1985 Return |

35.9%

|

31.1%

|

|

31.2%

|

31.6%

|

1985

|

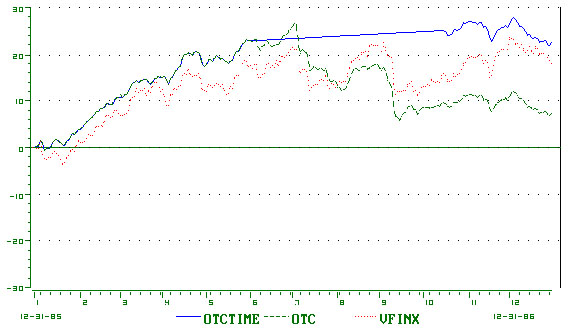

1986 1986 Return |

22.6%

|

7.5%

|

|

21.9%

|

-3.1%

|

1986

|

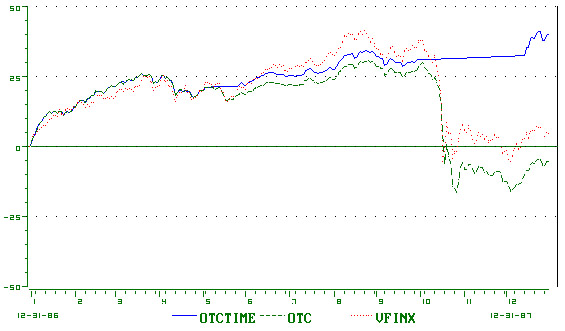

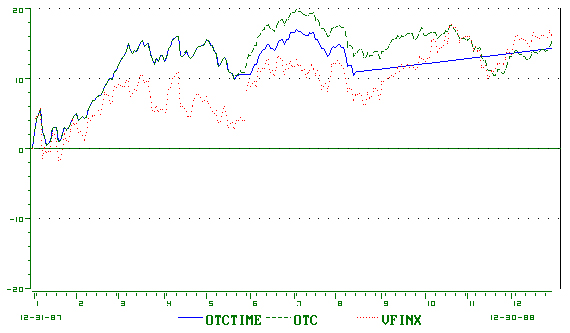

1987 1987 Return |

39.3%

|

-5.3%

|

|

42.0%

|

31.4%

|

1987

|

1988 1988 Return |

14.3%

|

15.4%

|

|

6.0%

|

16.6%

|

1988

|

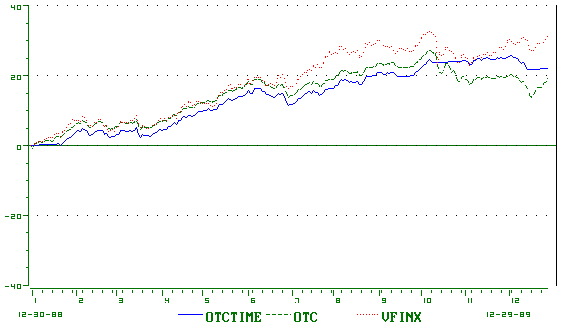

1989 1989 Return |

15.0%

|

19.5%

|

|

33.5%

|

31.6%

|

1989

|

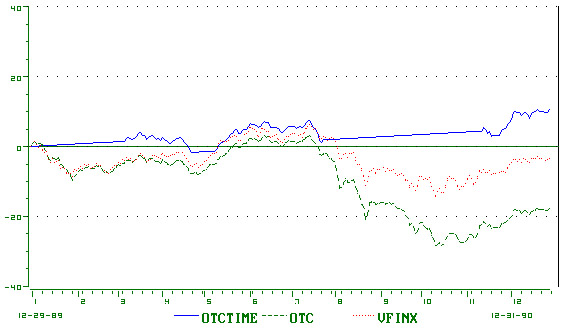

1990 1990 Return |

5.4%

|

-17.8%

|

|

8.4%

|

-3.1%

|

1990

|

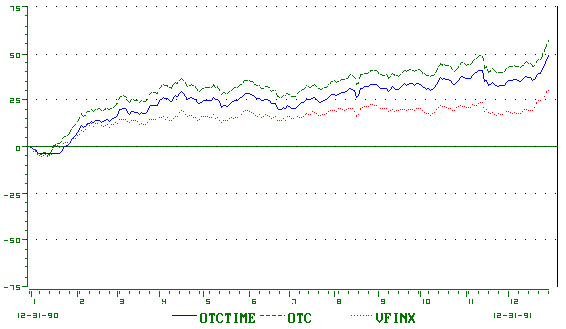

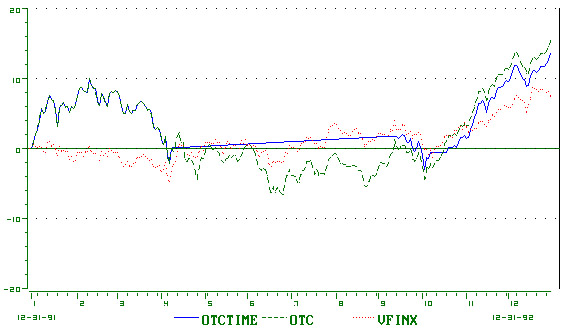

1991 1991 Return |

54.4%

|

56.8%

|

|

29.7%

|

31.4%

|

1991

|

1992 1992 Return |

13.5%

|

12.1%

|

|

1.1%

|

7.6%

|

1992

|

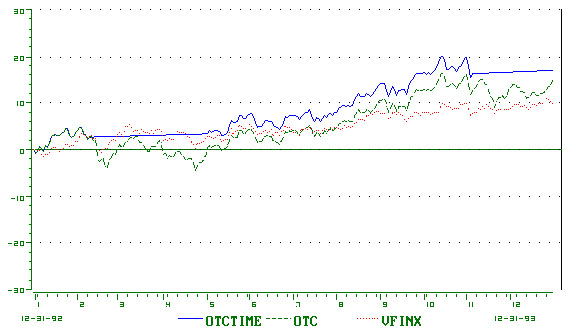

1993 1993 Return |

17.1%

|

13.1%

|

|

9.3%

|

10.1%

|

1993

|

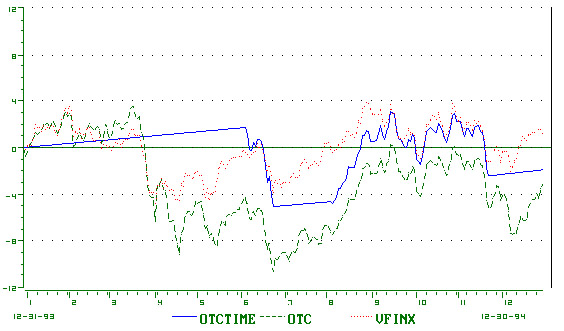

1994 1994 Return |

-2.0%

|

-3.1%

|

|

-1.7%

|

1.3%

|

1994

|

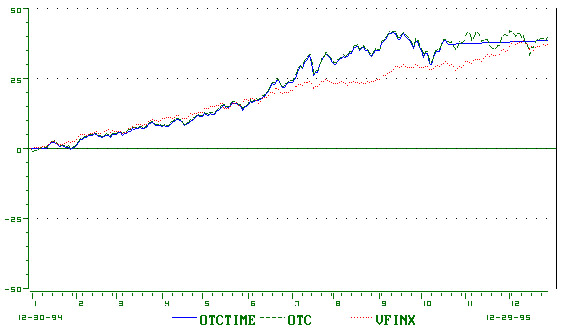

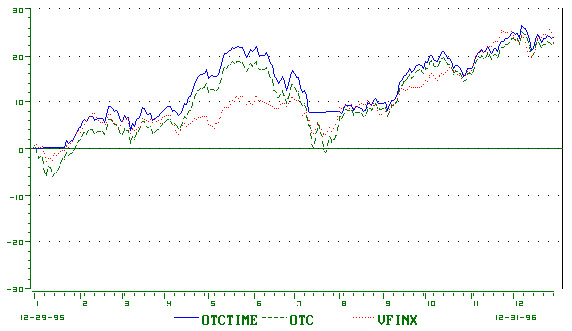

1995 1995 Return |

38.6%

|

39.9%

|

|

30.4%

|

37.5%

|

1995

|

1996 1996 Return |

24.0%

|

22.7%

|

|

20.9%

|

22.9%

|

1996

|

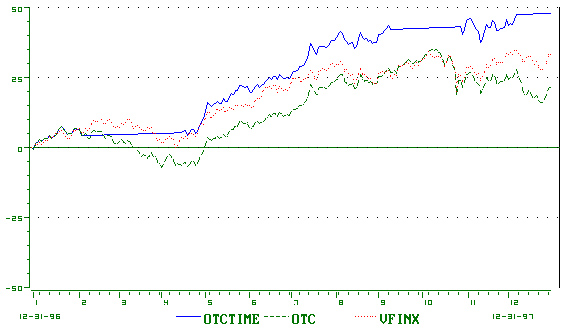

1997 1997 Return |

47.3%

|

21.6%

|

|

38.7%

|

33.4%

|

1997

|

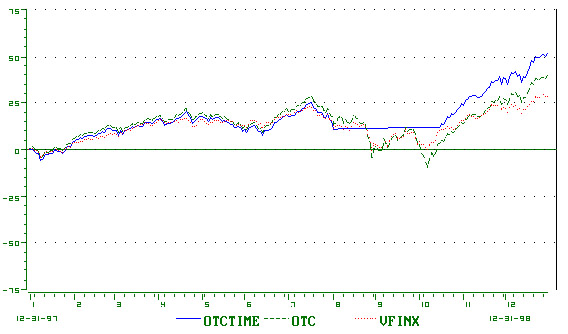

1998 1998 Return |

51.3%

|

39.6%

|

|

28.9%

|

26.7%

|

1998

|

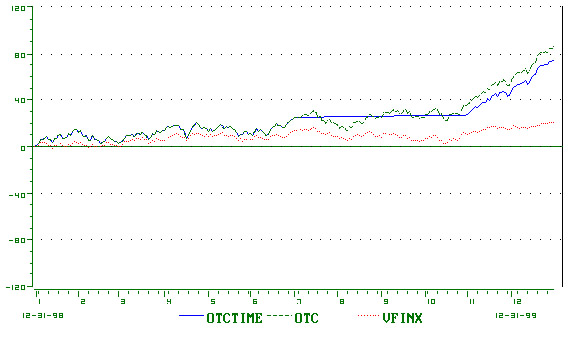

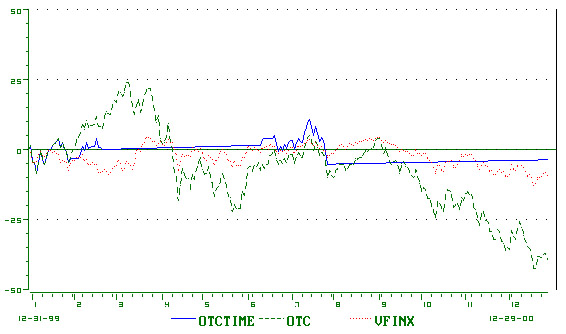

1999 1999 Return |

74.4%

|

85.6%

|

|

25.5%

|

21.0%

|

1999

|

2000 2000 Return |

-3.7%

|

-39.3%

|

|

-8.8%

|

-9.7%

|

2000

|

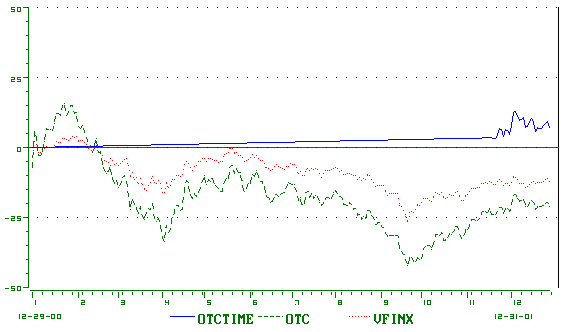

2001 2001 Return |

7.9%

|

-21.1%

|

|

4.5%

|

-11.9%

|

2001

|

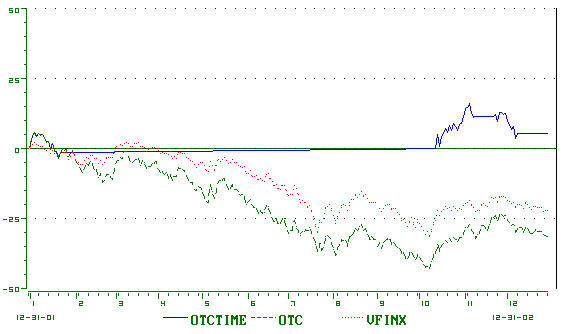

2002 2002 Return |

5.8%

|

-31.5%

|

|

3.5%

|

-22.1%

|

2002

|

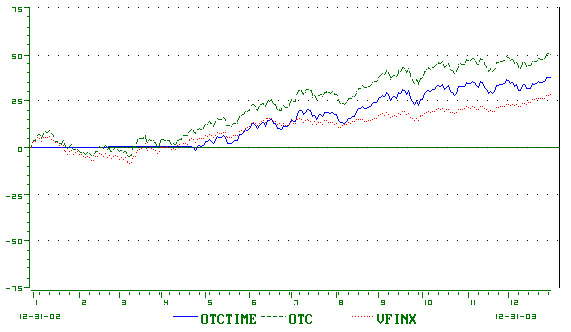

2003 2003 Return |

37.6%

|

50.1%

|

|

23.4%

|

28.7%

|

2003

|

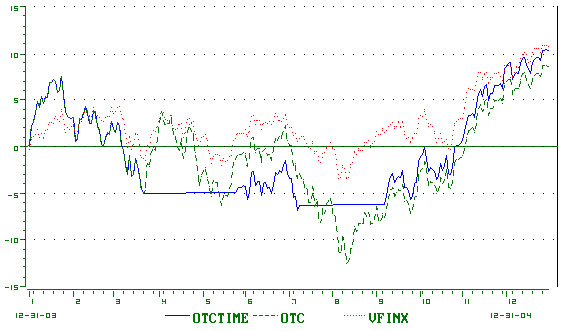

2004 2004 Return |

10.4%

|

8.6%

|

|

8.1%

|

10.9%

|

2004

|

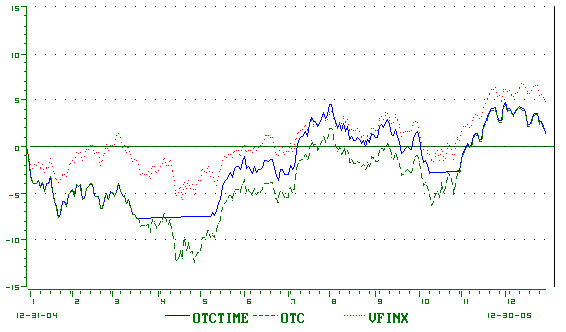

2005 2005 Return |

1.6%

|

1.4%

|

|

5.1%

|

4.9%

|

2005

|

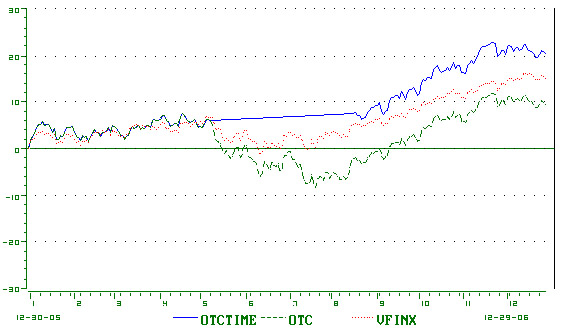

2006 2006 Return |

20.1%

|

9.5%

|

|

18.8%

|

15.8%

|

2006

|

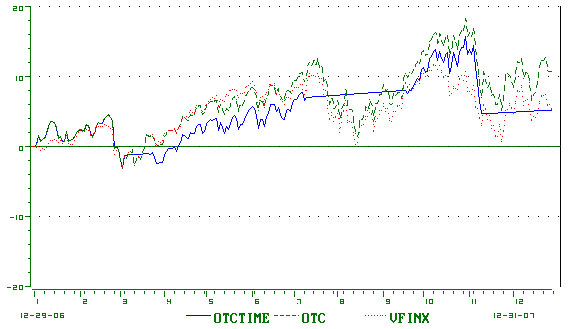

2007 2007 Return |

5.1%

|

9.8%

|

|

0.8%

|

5.5%

|

2007

|

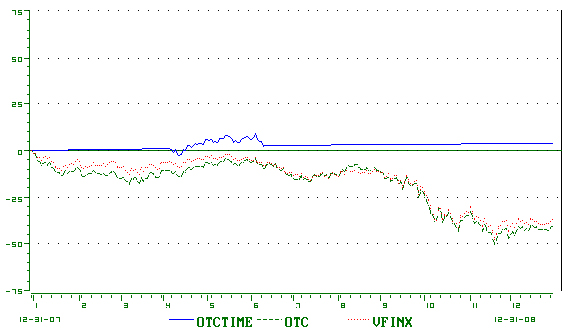

2008 2008 Return |

4.3%

|

-41.5%

|

|

0.8%

|

-37.0%

|

2008

|

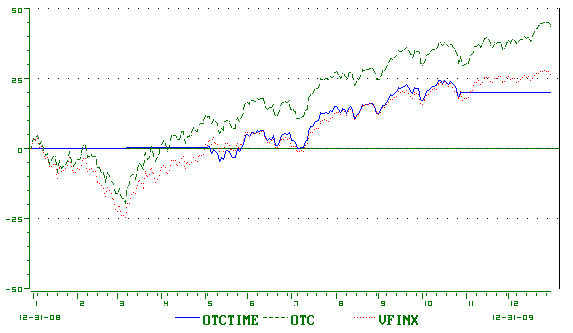

2009 2009 Return |

20.0%

|

43.9%

|

|

19.7%

|

26.6%

|

2009

|

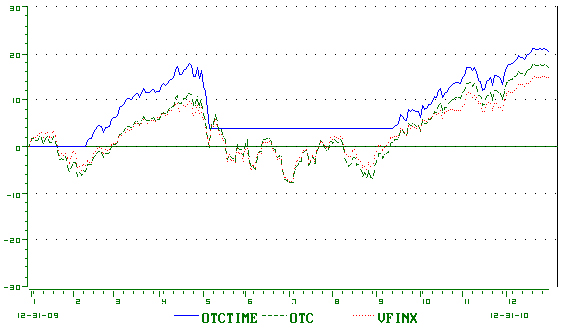

2010 2010 Return |

25.2% |

16.9% |

|

19.6% |

14.9% | 2010 |

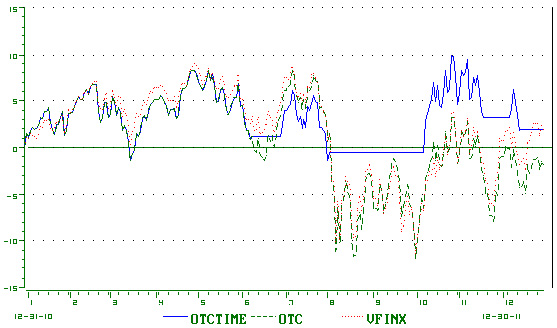

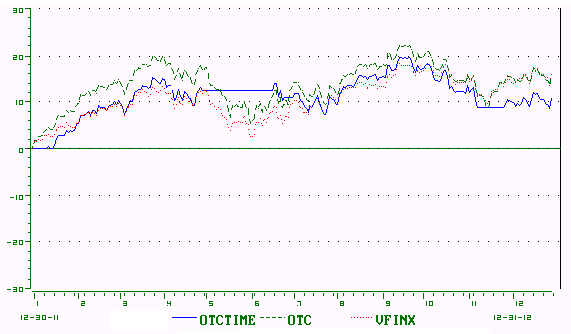

2011 2011 Return |

1.5% |

-1.8% |

|

3.3% |

2.1% | 2011 |

2012 2012 Return |

10.7% |

15.9% |

|

11.4% |

15.9% | 2012 |

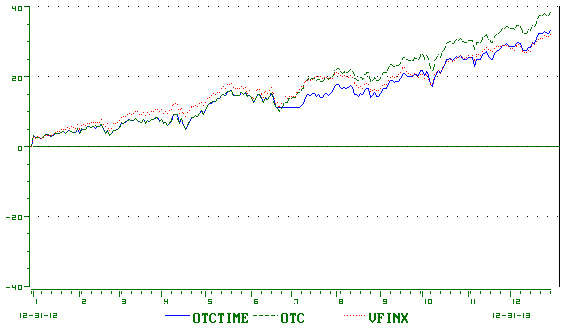

2013 2013 Return |

33.5% |

38.3% |

|

27.8% |

31.9% | 2013 |

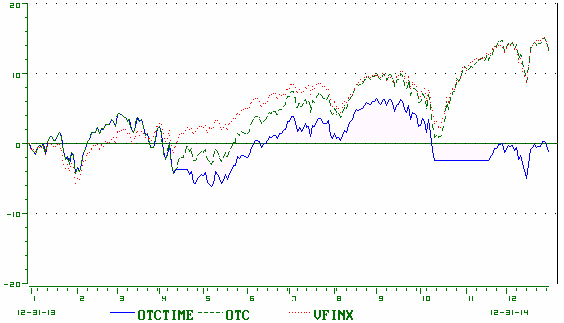

2014 2014 Return |

-1.2% |

13.4% |

|

1.8% |

13.7% | 2014 |

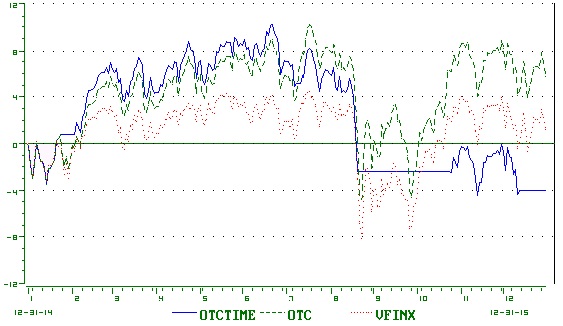

2015 2015 Return |

-4.5% |

5.7% |

|

-6.9% |

1.2% | 2015 |

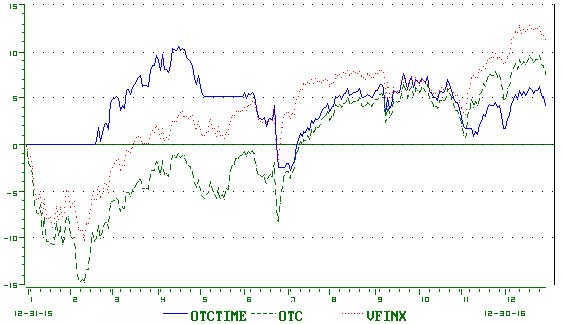

2016 2016 Return |

4.2% |

7.5% |

|

6.3% |

11.3% | 2016 |

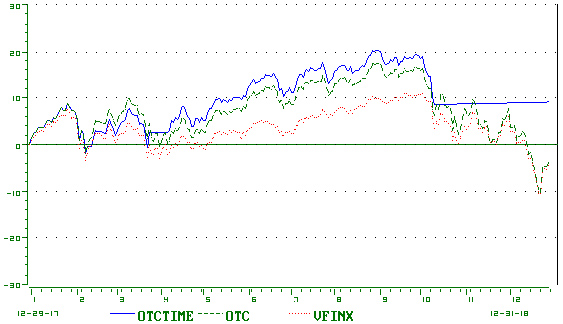

2017 2017 Return |

28.2% |

28.2% |

|

21.7% |

21.8% | 2017 |

2018 2018 Return |

9.1% |

-3.9% |

|

4.2% |

-4.4% | 2018 |

2019 2019 Return |

6.6% |

35.2% |

|

6.1% |

31.5% | 2019 |

2020 2020 Return |

41.8% |

43.6% |

|

20.8% |

18.4% | 2020 |

2021 2021 Return |

22.3% |

21.4% |

|

28.7% |

28.7% | 2021 |

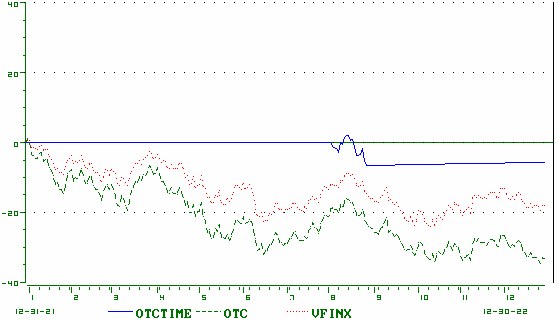

2022 2022 Return |

-4.5% |

-33.1% |

|

-1.8% |

-18.1% | 2022 |

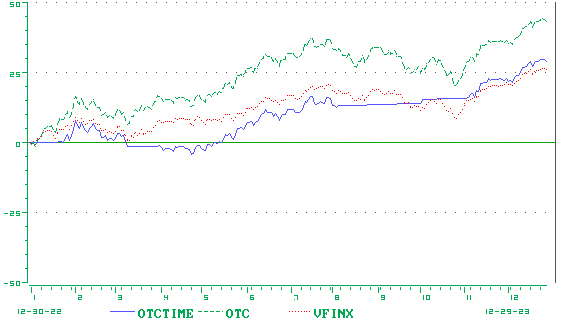

2023 2023 Return |

29.4% |

43.4% |

|

18.7% |

26.3% | 2023 |

2024 2024 Return |

23.5% |

28.6% |

|

20.0% |

25.0% | 2024 |